aurora co sales tax 2021

Condo located at 14231 E Dickinson Dr Aurora CO 80014 sold for 267000 on Feb 26 2021. The latest sales tax rates for cities in Colorado CO state.

1006 S Uravan Ct Aurora Co 80017 Redfin

The December 2020 total local sales tax rate was also 8000.

. City of Aurora Tax PO Box 913200 Denver CO 80291-3200. 3 beds 275 baths 1724 sq. Effective June 1 2021 Menstrual Care Products are exempt from City of Aurora sales tax April 20th 2021.

City of Aurora Tax MAC C7301-L25 1740 Broadway St - LL2 Denver CO 80274 New tax returns will be mailed by May 3. Fourteen states including Colorado allow local governments to collect an income tax. 200 per month on compensation over 250.

The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. The Aurora Cd Only Sales Tax is collected by the merchant on. Wholesale sales are not subject to sales tax.

There will no longer be a Schedule C available for sales and use. Employees and Employers are subject to OPT of 2 per month if. Friday January 01 2021.

Subscribe to On Havana. What is a local income tax. There are approximately 213758 people living in the Aurora area.

Check back for regular updates. The Aurora sales tax rate is. Including vaulted ceilings updated LED li.

The clarifying city ordinance can be found at this link. Aurora Sales Tax Rates for 2022. Tax returns and Payments.

3845 Eaton Park St is located in Green Valley Ranch East Aurora. Colorado State Sales Tax information registration support. Did South Dakota v.

One removes the sales. Go to the Retail Delivery Fee web page for information on how to begin collecting and remitting. Updated 12021 Effective July 1 2006 the Scientific and Cultural facilities District CD of 010 consists of all areas within Arapahoe County Effective December 31 2011 the Football District salesuse tax of 010 expired within Arapahoe County.

The Colorado sales tax rate is currently. Select the Colorado city from the list of popular cities below to see its current sales tax rate. Step 1 of 2.

This Part 1 outlines criteria for determining. Aurora has a higher sales tax than 886 of Colorados other cities and counties. 15151 E Alameda Pkwy Aurora CO 80012-1555.

Rates include state county and city taxes. Effective July 1 2022. March 8 2021 at 745 pm.

This clarification is effective on June 1 2021. The County sales tax rate is. The latest sales tax rate for Aurora CO.

Aurora took a major step Monday toward eliminating the citys sales tax on menstrual products putting it in line to. The Aurora Colorado sales tax is 290 the same as the Colorado state sales tax. What is the sales tax rate in Aurora Colorado.

Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. The Aurora Colorado sales tax rate of 85 applies to the following twelve zip codes. The minimum combined 2022 sales tax rate for Aurora Colorado is.

Employee works within the city of Aurora for any period of time during such month. This is the total of state county and city sales tax rates. This rate includes any state county city and local sales taxes.

Gross earnings are 250 or more per calendar month. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe County. The County sales tax rate is.

Note that the State of Colorado has enacted the same clarification. Fri Jan 01 2021. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

Arvada CO Sales Tax. Recent Colorado statutory changes require retailers to charge collect and remit a new fee. Download and file the Retail Delivery Fee Return DR 1786 to register a Retail Delivery Fee account.

2020 rates included for use while preparing your income tax deduction. PO BOX 913200 AURORA CO 80291-3200. Total Sales Tax Rate.

Aurora Income Tax Information. The 85 sales tax rate in Aurora consists of 29 Colorado state sales tax 075 Adams County sales tax 375 Aurora tax and 11 Special tax. New licensing software is expected to be implemented in November 2018.

An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80011 80012 80014 and 80019. 3845 Eaton Park St was last sold on Aug 3 2021 for 626000. Aurora collects a 56 local sales tax the maximum local sales tax allowed under Colorado law.

Cost of Living Indexes. The Aurora Sales Tax is collected by the merchant on all qualifying sales made within Aurora. March 8 2021 at 748 pm.

Retailers that make deliveries must collect and remit a 027 retail delivery fee for each sale of taxable tangible personal property delivered by motor vehicle to a location in Colorado. Groceries are exempt from the Aurora and Colorado state sales taxes. Start filing your tax return now.

Beginning July 1 2022 retailers must collect a 027 retail delivery fee on every retail sale delivered by motor vehicle to a location within Colorado. TAX DAY NOW MAY 17th - There are -419 days left until taxes are due. In no event shall the amount of tax to be held be less than 375 400 in Arapahoe County of 50 of the permit fee determination assessment.

This property is not currently available for sale. Aurora Sales Tax Rates for 2022. 2020 rates included for use while preparing your income tax deduction.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. Ad New State Sales Tax Registration. An employee is any person who.

A local income tax is a special tax on earned income collected by local governments like counties cities and school districts. While Colorado law allows municipalities to collect a local. This sales tax will be remitted as part of your regular city.

Method to calculate Aurora sales tax in 2021. Wayfair Inc affect Colorado. 3845 Eaton Park St Aurora CO 80019 is a 3 bedroom 25 bathroom 2614 sqft single-family home built in 2021.

The city of Aurora imposes an Occupational Privilege Tax OPT on individuals who work within the city limits. Retail Sales 2 Revised August 2021 Colorado imposes a sales tax on retail sales of tangible personal property prepared food and drink and certain services as well as the furnishing of rooms and accommodations.

Chevrolets For Sale Chevrolet Inventory Aurora Co Len Lyall Chevrolet

2021 Porsche 718 Cayman Gt4 Coupe Ratings Pricing Reviews Awards

Ohio Income Tax Calculator Smartasset

How To Apply For A Colorado Sales Tax License Department Of Revenue Taxation

How To Buy A Car In Another State Tom Gill Chevrolet

Is Food Taxable In Colorado Taxjar

Colorado Sales Tax Rates By City County 2022

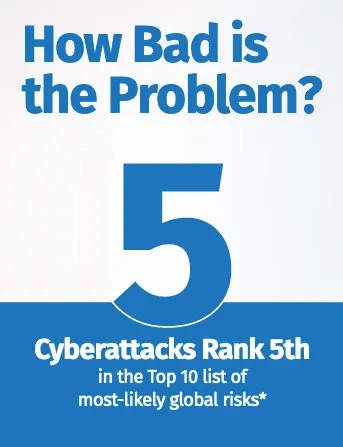

Ransomware Attack List And Alerts Cloudian

Election 2021 Colorado 6 Big Takeaways From The Results

Close Sales Tax Account Department Of Revenue Taxation

New And Used 2021 Jeep Grand Cherokee For Sale In Denver Co Cars Com

Colorado Localities Create Nexus Provisions Grant Thornton

Marijuana Sales Tax Department Of Revenue Taxation

Aurora To Become First Colorado City To Exempt Diapers Adult Incontinence Products From City Sales Tax

1276 Cranbrook Cir Aurora Il 60502 Redfin